45+ debt-to-income ratio calculator for mortgage

Yesterday it was 630. To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments.

Is It Beneficial To Transfer A Housing Loan From One Bank To Another Quora

Ad Top Home Loans.

. Divide your monthly debts 1850 by your gross monthly income 5000 and the result is a DTI ratio of 037 or 37. Try our mortgage calculator. Ad Get an idea of your estimated payments or loan possibilities.

Web Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. Web To determine your debt-to-income ratio also called your back-end ratio start by adding up all your monthly debt payments. Scroll down the page for more.

Veterans Use This Powerful VA Loan Benefit For Your Next Home. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000.

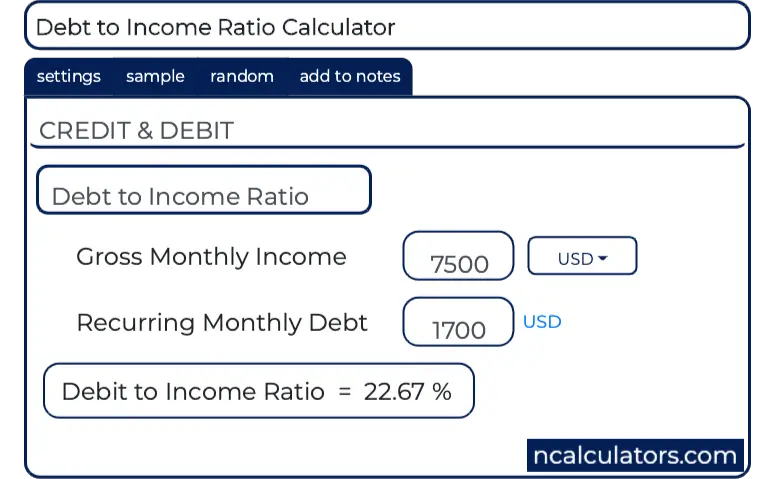

Web Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis. Debt To Income Calculator. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan.

Calculate Your Mortgage Payments With Our Free Mortgage Calculator Now. Ad Calculate Your Payment with 0 Down. Web To calculate your front-end ratio add up your monthly housing expenses only divide that by your gross monthly income then multiply the result by 100.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. Web 45 debt-to-income ratio calculator for mortgage Senin 20 Maret 2023 Edit. Web How to calculate your debt-to-income ratio.

Web The calculator works immediately as you slide or input your gross monthly income monthly debts loan terms interest rate and down payment. Ad Calculate Your Monthly Payment with Our Free Online Mortgage Calculator. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Web Your gross monthly income is 5000. A DTI of 43 is typically the highest. Ad See how much house you can afford.

Web Your front-end or household ratio would be 1800 7000 026 or 26. Web According to a breakdown from The Mortgage Reports a good debt-to-income ratio is 43 or less. To get the back-end ratio add up your other debts along with your housing expenses.

36 of 4853 monthly salary 1747 total debit based on debt. Ad Calculate Your Payment with 0 Down. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments.

Web Your debt-to-income ratio matters when buying a house. Many lenders may even want to see a DTI thats closer to. Using these same numbers a simple mortgage calculator will show.

But with a bi-weekly. Estimate your monthly mortgage payment. Debt To Income Ratio Dti What It Is And How To Calculate It.

Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt. Get competitive rates terms rural expertise and local service from Rural 1st. Veterans Use This Powerful VA Loan Benefit For Your Next Home.

One week ago the 15-year fixed-rate mortgage was at. Monthly debts for DTI include. Web Your debt-to-income ratio or DTI is a percentage that tells lenders how much money you spend on monthly debt payments versus how much money you have coming.

Web To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments student loan payments car payments minimum. Web 2 days agoThe average interest rate on the 15-year fixed refinance mortgage dropped to 628. Web In todays Tip Tuesday Kam explains what the debt-to income ratio that most lenders require SUBSCRIBE to see new videos as soon as they are postedFind us.

Web This means that even though the mortgage amount of 1359 a month was within the recommended 28 of monthly salary it would be too high for an affordable mortgage payment when other debts are considered.

Debt To Income Ratio Calculator Lowermybills

Debt To Income Ratio Calculator Ramsey

Identifying And Trading A Bear Market

Debt To Income Ratio Calculator Lowermybills

Debt To Income Ratio Calculator

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

A Clue You Re Likely To Default On Your Mortgage Ratesdotca

What Is The Debt To Income Ratio For A Mortgage Freeandclear

How Your Debt To Income Ratio Can Affect Your Mortgage

Debt To Income Dti Ratio Calculator Money

Mortgage Cash Flows And Employment Sciencedirect

Debt Income Ratio Calculator Front End Back End Dti Calculator For Mortgage Qualification

How Do Charge Cards Affect Your Credit Score Forbes Advisor

Debt To Income Ratio To Be Able To Qualify For A Mortgage

Cmp 8 02 By Key Media Issuu

Debt To Income Ratio Calculator Due

Debt To Income Ratio Calculator Interactive Hauseit Nyc